Master Your Customer Acquisition Cost Calculation

Figuring out your Customer Acquisition Cost (CAC) isn't just some boring financial task—it's about getting a real, honest look at the health of your business. If you ignore it or get it wrong, you could be staring down a cash-flow crisis, spending way more to get customers than they'll ever be worth to you.

Think of it as your roadmap to sustainable growth.

Why Your CAC Calculation Is a Growth Engine

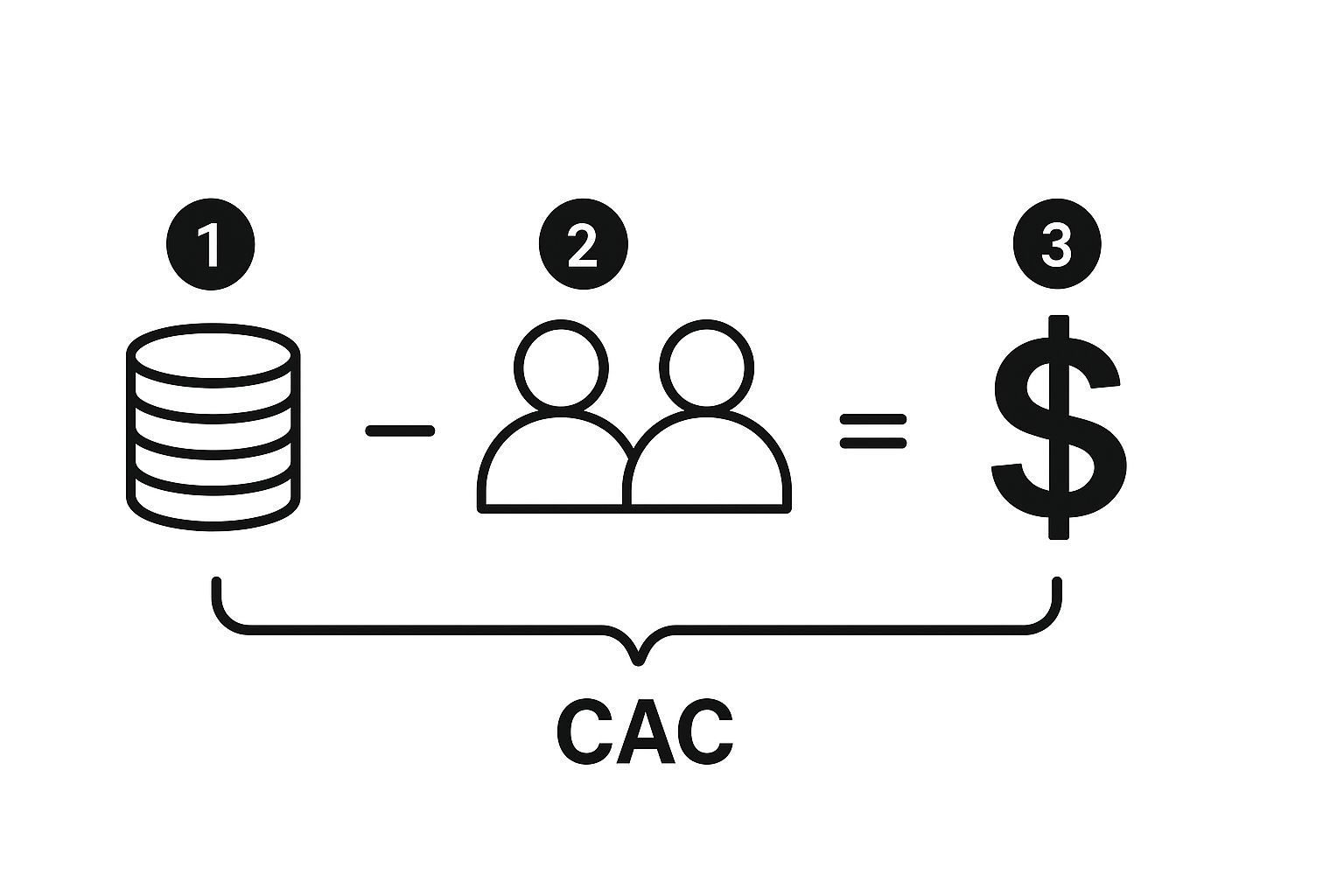

Let's get straight to it. The basic formula is beautifully simple:

(Total Sales & Marketing Costs) / (Number of New Customers Acquired) = CAC

But don't let that simplicity fool you. This single number tells a powerful story about your marketing efficiency and whether your business model is actually viable long-term. The catch? Its accuracy depends entirely on what you're actually counting as "costs." To get a true picture, you need to dig much deeper than just your ad spend.

This visual breaks down the core idea, but the real magic is in the details of what goes into those two buckets: "Total Costs" and "New Customers." Let’s unpack that.

To get a truly useful CAC, you need to be honest with yourself about every single dollar spent to win over new business. This is what's often called a "fully loaded" CAC.

Core Components of the CAC Formula

This table breaks down the key inputs for an accurate customer acquisition cost calculation. It clarifies what to include in your costs and how to define your customer count, helping you avoid common missteps.

| Component | What to Include | Common Pitfalls |

|---|---|---|

| Sales & Marketing Costs | Salaries: Base pay and benefits for your sales and marketing teams. Ad Spend: All paid media (Google, Meta, TikTok, etc.). Software: CRM, email platforms, analytics tools. Overhead: Agency fees, freelance costs, a portion of office rent. |

Forgetting to include salaries and software costs. This is the most common mistake and will give you a dangerously low CAC. |

| New Customers | Only genuinely new customers acquired within the specific time frame. This means their first-ever purchase. | Including returning or repeat customers in your "new customer" count. This will artificially deflate your CAC and hide underlying problems. |

Getting these two components right is non-negotiable for a calculation you can actually trust to make smart business decisions.

Don't Get Fooled by Your Numbers

It’s just as important to be strict about defining a "new customer." This number should only include first-time buyers within your chosen timeframe.

It’s easy to accidentally lump in returning customers, which makes your CAC look better than it is. But that false sense of security can be deadly. You might think your marketing is crushing it, when in reality, you're just getting repeat business from an existing base.

The pressure to acquire customers has never been more intense. Research shows that the average CAC has skyrocketed by a staggering 222% between 2013 and 2022, a trend driven by climbing ad prices and fierce competition. This makes an accurate calculation more critical than ever.

If you’re looking for ways to streamline your own processes, you might find some useful ideas in our automation blog posts. After all, efficiency is the name of the game when costs are on the rise.

Where to Find the Data for an Accurate Calculation

Any CAC calculation is only as good as the numbers you feed it. As the old saying goes: garbage in, garbage out. Let's get practical and pinpoint exactly where to hunt down the figures you need for a trustworthy and repeatable process.

First up, your advertising platforms. You need to pull comprehensive spending reports from every single channel. That means exporting data directly from your Google Ads and Meta Ads dashboards. Don’t stop there. Be sure to grab the numbers from other channels like TikTok, LinkedIn, or any affiliate marketing platforms you’re using.

Next, you have to account for the human cost. Your sales and marketing team salaries are a massive part of your acquisition expenses. Head over to your payroll system and export the gross salary data for everyone involved in bringing new customers through the door. This isn't just their base pay; make sure it includes payroll taxes and benefits for a true cost.

Hunting Down All Your Sales and Marketing Expenses

Think beyond the obvious. Your total costs include way more than just ad spend and salaries. To get a fully loaded CAC, you have to track down every related expense.

This is where you need to take a hard look at your software stack. Those monthly and annual SaaS fees add up fast and are a direct cost of acquiring customers.

- CRM and Automation Tools: Export the billing data from your CRM, like Salesforce or HubSpot. Do the same for your marketing automation platform, whether it's Mailchimp or Klaviyo. These are the backbone of your acquisition machine.

- Analytics and SEO Software: Don’t forget your subscriptions for powerful tools like Ahrefs or SEMrush. Any analytics software you use to track performance and guide your strategy belongs here.

- Creative and Content Tools: Are you paying for design software like Adobe Creative Cloud? Stock photo subscriptions? Any other tools your content team relies on? Add them to the list.

I know, pulling all this together can feel like a chore, but it’s absolutely essential. You simply can't make smart decisions about your marketing budget or overall strategy without a complete and accurate picture of your spending.

Pro Tip: I've found the best way to manage this is to set up a simple spreadsheet or dashboard dedicated to tracking these costs. Just update it monthly. It turns what could be a quarterly headache into a smooth, routine check-in on your business's health.

Defining Your New Customer Count

Once you've wrangled all your costs, you need the other half of the equation: the number of new customers. This figure should come directly from your single source of truth—be it your CRM, an e-commerce platform like Shopify, or an internal database.

This next part is critical. You must filter this list to only include customers who made their first-ever purchase during the period you're measuring. If you include returning customers, you'll artificially deflate your CAC and get a dangerously misleading sense of security.

For example, say you brought in 150 total customers last month, but 50 of them were previous buyers. For your CAC calculation, your "new customer" count is 100, not 150. This distinction is non-negotiable if you want a result you can actually trust.

Calculating CAC in the Real World

Alright, let's move from theory to reality. Seeing how Customer Acquisition Cost (CAC) plays out with real numbers is where the rubber meets the road. It's fascinating how much this single metric can change depending on the type of business you're running.

We'll look at three common scenarios to bring this to life.

The E-commerce Store

First up, imagine a small e-commerce shop that sells custom-printed mugs. In the first quarter, they went all-in on their marketing.

Here’s the breakdown:

- They spent a total of $12,000 on Google and Facebook ads.

- The marketing team's salaries for that quarter came to $8,000.

- All that effort brought in 400 brand-new customers.

When you add up the costs ($12,000 + $8,000 = $20,000) and divide by the new customers, you get your CAC. For this mug shop, the math is ($20,000 / 400), which works out to $50 per customer. Not bad for a physical product.

The B2B Software Firm

Now, let's shift gears to a B2B software company. Their world is completely different—long sales cycles, multiple decision-makers, and high-touch interactions.

In the same quarter, they spent $40,000 on advertising and a hefty $60,000 on their sales and marketing staff. Over those three months, they managed to close deals with 80 new enterprise clients.

Do the math here—($100,000 / 80)—and you land at a CAC of $1,250.

At first glance, $1,250 per customer might seem terrifyingly high. But you have to remember the context. Each of these clients is on a long-term contract, with an average lifetime value (LTV) that easily clears $50,000. Suddenly, that acquisition cost looks like a very smart investment.

| Model | Quarter Costs | New Customers | CAC |

|---|---|---|---|

| E-commerce | $20,000 | 400 | $50 |

| B2B Software | $100,000 | 80 | $1,250 |

The Local Service Business

Finally, let's look at a local plumbing business. Their sales process is much quicker and more direct.

In Q1, their marketing spend was $5,000 on local ads, and they paid their sales staff $3,000. This resulted in 50 new maintenance contracts.

The calculation is straightforward: ($8,000 / 50) gives them a CAC of $160. This number is crucial for them. It directly informs how they price their service calls and contracts to ensure every new customer is profitable from day one.

These examples really drive home the point: there's no "good" or "bad" CAC without context. A $50 CAC is great for retail, while a $1,250 CAC is perfectly healthy for enterprise software. It all comes down to your business model and what each customer is worth over time.

Key takeaway: Your CAC is the compass for your marketing budget. It tells you exactly which channels are worth scaling and which ones are just draining your resources.

My advice? Track your CAC every single quarter. If you see it start to creep up, it’s an immediate signal to investigate. Is a specific ad channel underperforming? Are your team's costs getting out of hand? Staying on top of this prevents small issues from turning into big, expensive problems. Knowing your number is the first step, but acting on it is what drives real growth.

Benchmarking Your CAC Against Industry Standards

So you've done the math and landed on a number for your Customer Acquisition Cost. Now what? Is it good? Bad? About average?

Honestly, a raw CAC figure on its own is just a vanity metric. Its real power comes from putting it into context. A "healthy" CAC for a fintech company could easily sink an e-commerce store, simply because every industry plays by different rules. Things like the length of your sales cycle, average customer lifetime value (LTV), and how crowded your market is will create massive differences in what’s considered a sustainable cost.

Finding Your Industry's Baseline

The first thing you need to do is find the right yardstick to measure against. This means digging into industry-specific data. You can often find great insights in the financial reports of public companies in your space, market research reports, and specialized business publications.

This research can uncover some pretty stark contrasts. For example, a look at CAC across different industries in 2024 shows just how varied acquisition strategies are. Industries with long sales cycles and high-value deals, like Financial Services or Legal Services, often have a much higher CAC—sometimes ranging from $500 to $1,200. You can find more detailed breakdowns by industry to see how your sector compares.

But don't just grab the first number you see and run with it. You have to dig a little deeper:

- Business Model: Are you comparing your B2B SaaS company to a B2C retailer? They aren't the same.

- Market Maturity: Is the benchmark from a well-established market leader or a scrappy, high-growth startup? Their spending will look very different.

- Geographic Focus: Acquiring a customer in New York City costs a lot more than acquiring one in a smaller market. Location matters.

Introducing the LTV to CAC Ratio

While industry benchmarks are a great starting point, the most powerful comparison is one you make internally. This is where the Lifetime Value (LTV) to CAC ratio becomes your best friend. This single metric is way more revealing than CAC alone because it’s all about profitability.

It answers the most critical question in business: are the customers you're bringing in actually worth more than what you paid to get them?

The LTV:CAC ratio is your true north for sustainable growth. It tells you if you have a viable business model or just a leaky bucket that's losing money on every new customer.

A widely accepted rule of thumb is that a healthy LTV:CAC ratio is 3:1 or better. Put simply, for every dollar you spend on acquisition, you should be generating at least three dollars in lifetime value.

If your ratio is 1:1, you’re essentially breaking even on the acquisition itself, which means you're losing money once you factor in the costs to serve that customer. On the flip side, if your ratio is pushing 5:1 or higher, you might actually be under-investing in marketing and leaving growth on the table.

Actionable Strategies to Reduce Your CAC

Figuring out your Customer Acquisition Cost is just the first step. The real magic happens when you start actively pushing that number down. A lower CAC means better profits and, frankly, more breathing room to scale your business. This is where you turn raw data into smart, decisive action.

Here’s a secret: lowering your CAC isn't always about slashing your marketing budget. More often than not, it’s about spending smarter. You need to optimize every single touchpoint on the customer journey, from the first ad they see to the final click on the checkout button. There are always efficiencies to be found.

Optimize Your Conversion Funnel

One of the quickest wins for lowering CAC is to boost your conversion rates. Think about it—if you can get more customers from the exact same amount of traffic, your cost per acquisition has to go down. It's simple math.

Start with your landing pages. Are they clear? Compelling? Do they have a single, obvious call-to-action? I’ve seen huge lifts from A/B testing simple things like headlines, hero images, and button copy. You have to test what actually resonates with your audience.

A tiny improvement can have a massive impact. Bumping your conversion rate from 1% to 2% doesn't just double your customers; it literally cuts your CAC in half for that specific channel.

Don’t stop at the landing page. Look at your entire signup or checkout process. Is it a smooth ride, or are there bumps causing people to bail? Things like removing unnecessary form fields or adding more payment options can make a world of difference in preventing drop-offs. For a deeper dive, there are plenty of strategies to effectively reduce your customer acquisition cost you can explore.

Double Down on Cost-Effective Channels

Let's be real: not all marketing channels are created equal. Paid ads can deliver results fast, but they're often the priciest game in town. To bring your blended CAC down, you have to nurture channels that are more sustainable and don't cost an arm and a leg.

Here are a few of my favorites:

- Search Engine Optimization (SEO): Creating genuinely helpful content that ranks in search engines is a long-term play, but the payoff is huge. It brings in a steady flow of high-intent visitors without a per-click cost.

- Referral Programs: Your happiest customers can be your most effective marketers. A well-designed referral program gives them a reason to spread the word, bringing in new business for a fraction of what you’d spend elsewhere.

- Email Marketing: An email list is an asset you own. It’s a direct line to an engaged audience, letting you drive sales and repeat business with an incredibly high ROI.

The relentless rise in digital ad costs makes these channels more critical than ever. We saw mobile app acquisition costs shoot up by 60% between 2019 and 2024, partly thanks to privacy shifts like Apple's iOS 14.5 update. With data tracking getting trickier, owned channels like email and referrals offer a more reliable and affordable way to grow.

Sharpen Your Targeting and Retention

Finally, you can lower your CAC by simply stopping the waste. Stop spending money trying to convert the wrong people.

Get surgical with your ad campaign targeting. Use negative keywords to weed out irrelevant searches, build lookalike audiences based on your best customers, and be ruthless about excluding demographics that just don't convert.

Most importantly, don't get so caught up in acquisition that you forget about retention. It is always cheaper to keep a customer you already have than to find a new one. By focusing on keeping customers happy and encouraging them to come back, you increase their lifetime value (LTV). A higher LTV makes your current CAC far more sustainable and gives you more firepower in your acquisition budget. If you're running a subscription business, it's vital to know how to manage your subscription service effectively to keep those customers happy and subscribed.

Common Questions About Calculating CAC

Once you start digging into your customer acquisition cost, you'll find the basic formula is just the beginning. Real-world business is messy, and a few common questions always pop up. Let's clear up the confusion so you can get numbers that are actually useful.

First off, how often should you even be calculating this? For most businesses I've seen, a monthly or quarterly rhythm works best. A monthly check-in is great for making quick, tactical tweaks to your marketing campaigns. But a quarterly review smooths out those weird monthly spikes and gives you a much more stable, big-picture look at what's really going on with your acquisition engine.

Simple vs Fully Loaded CAC

This is a big one. You need to understand the difference between a "simple" and a "fully loaded" CAC. A simple CAC might just count your direct ad spend, but that’s a dangerously incomplete picture.

A fully loaded CAC is the only number that really matters. It forces you to account for all the associated costs that go into winning a new customer.

- Salaries and benefits for your sales and marketing teams.

- Every penny of ad spend across all your channels.

- The cost of your tech stack—CRM, analytics tools, email platform, you name it.

- Any agency fees, freelance help, or related overhead.

If you want a true understanding of your profitability, you have to use the fully loaded calculation. Anything less is just a shot in the dark.

The point of calculating CAC isn't just to land on a number. It's to get a number you can trust to make critical decisions about your budget and strategy. A fully loaded CAC is the only way to get there.

Handling Different Customer Sources

Things get even more interesting when you start separating customers by how you found them. A common mistake I see is lumping customer retention costs into the CAC formula. The answer here is a hard no.

CAC is purely about acquiring new customers. The money you spend keeping existing clients happy is a totally different metric: customer retention cost (CRC). If you mix the two, you’ll artificially inflate your CAC and get a skewed view of how well your acquisition efforts are performing.

So, what about organic channels? For a "blended CAC," you just throw all new customers into the pot, regardless of where they came from. But the real magic happens when you get more specific. To find your "organic CAC," you need to attribute the costs that drove that traffic—like the salaries of your content team, the price of your SEO tools, and any freelance writing fees. Divide those specific costs by the number of new customers from organic, and you've got a seriously powerful metric.

To really nail down your acquisition costs, it helps to have a solid foundation in the core definition, which is often framed as understanding Cost Per Acquisition (CPA). And if you're looking for ways to make your marketing machine more efficient, looking into what is automation software can open your eyes to new ways to streamline your efforts and bring those costs down.

Ready to save time and get more matches on your favorite dating apps? Auto-Swiper is the powerful browser extension that automates the swiping process for you. Check it out and start maximizing your online dating experience today at https://auto-swiper.ch.